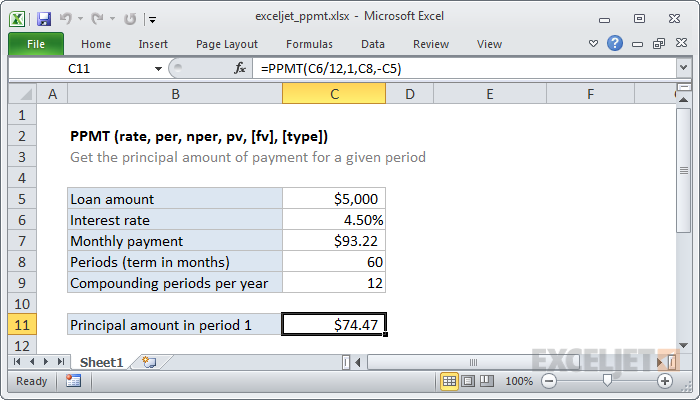

Do you want to know how much of the principal amount of the loan you repay? Use Excel’s PPMT function to help you. This guide will explain how to do it.

The Description of PPMT Function in Google Sheets and Excel

Is there a loan repayment schedule in Excel and PPMT calculator? Google Sheets tool offers a huge number of unique features, ready-made formulas, and logic functions for working with text, graphics, and tables in one place. The PPMT function calculates the principal payment of an investment based on periodic, constant payments and a constant interest rate over a specified period.

When you pay off a loan, you are likely to make regular payments of the same amount. Part of each payment will go towards paying off the interest on the loan, and the other part will go towards paying off the amount you borrowed. However, how these payments are distributed from month to month is not uniform. The more payments you make, the lower your interest payments become. As a result, the amount that goes to reduce your loan (payment on the principal debt) increases every month.

Despite the fact that the compound interest formula is understandable to a high school student who has mastered the law of geometric progression, the practice of consumer lending confirms the need to further strengthen the financial literacy of borrowers. The percentage growth model and methods for estimating payment flows have long been programmed into financial calculators and spreadsheets as built-in functions. The quartiles, along with the smallest and largest numbers in the set, create a “sum of five numbers.” This can help you quickly see where the middle of the data is and how to spread it out.

What Does PMT Excel Mean?

Digital platforms are a rapidly growing group of companies that have many features, including network externalities, and that apply specific strategies in the course of doing business. At the same time, the consequences of platform mergers are not well understood by financial researchers. The vertically integrated structure will carry out a full cycle of activities from creating content to its distribution, and display, as well as technological and marketing support, with the possibility of maximizing audience involvement through a single loyalty program that connects online and offline products and services.

There are many tools for working with data, such as Google Sheets, Excel, Airtable, tables in Notion, etc. They will be useful in the work of an Internet marketer or other specialist. However, quite often, the question arises of using the capabilities of certain services on different devices, in the desktop or mobile version, in other locations or countries.

The PPMT function syntax has the following arguments:

- Rate is a required argument. The interest rate for the period.

- The period is a required argument. The period for which the value should be set in the range from 1 to the value of the “Kper” argument.

- Kper is a required argument. The total number of financial rent payment periods.

- Sv is a mandatory argument. The present value is equal to the aggregate value of a series of future payments.

- MV Optional. The future value or cash balance to be reached after the last payment. If the argument “Mv” is not specified, it is assumed to have a value of 0; that is, the future value of the loan is 0.

- Type is an optional argument. The number of 0 or 1 determines when payments are made.